Originally posted Apr. 28, 2021.

Summary

- Net-net trading at 49% to book (book being cash and public stock.).

- Catalyst is share buyback.

- Problem: Liquidity is poor: I could only buy $1440 before moving the price.

- Insider buying of $19K.

- A teaser article is where I haven't gone too much in-depth, as compared to a hidden gem where I go deep.

Note: All numbers in CAD.

About Minco Capital:

Minco Capital Corp (CVE: MMM) is a closed end equity fund in Canada that is trading at 49% to book. Book being cash and public equities. Book value is $0.21 and the stock is trading at $0.105, giving theoretical upside (if they liquidate all at once and issue special dividend) of 100% to current share price. Obviously this won't happen so we need a large margin of safety. I expect share price to go to $0.16-$0.17/ share. This gives 60% share upside to current levels.

In the previous FY 2019, they bought back 2.6MM shares so they have evidence of actually buying back stock, not just issuing NCIB.

You don't have to worry about insiders dumping stock because "To the knowledge of the Company, no director, senior officer or other insider of the Company currently intends to sell any common shares under the (NCIB) normal course issuer bid*."

The company can buy up to 2,388,594 stock until March 31 2022.

Because the liquidity is low (15K/daily average volume shares traded), the buyback will yank up the stock price.

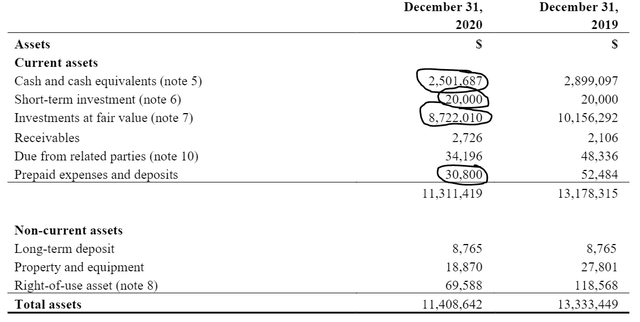

Net-net key financials:

Market cap: $4.57MM

Cash + prepaid expenses: $2.53MM

Adjusted short term investments + investments at fair value: $6.78MM*

Total liabilities: $137K

No minority interest, no preferred stock.

= (Cash+ Investments- Total Liabilities) / Market Cap

= ($2.53MM+$6.78MM-$0.137MM)/$4.57MM

= 100% upside to current stock level. No rounding.

Figure 1. Asset add up. I am excluding receivables and due from related parties.

Let us evaluate how liquid these investments are:

Figure 2. All investments.

Some of these stocks have gone down since December 31 2020 (last recording) so I made one current to April 26 2021:

| Company | Current Share Price | # Stock Quantity | $Total Value | Market Cap. | $Daily traded volume. |

| Minco Silver Corp.** | $0.45 | 11,000,000 | $4.95MM | $28MM | $19K |

| Hudson Resources | $0.18 | 2,142,857 | $396K | $34MM | $70K |

| Global X Lithium ETF*** | $78.96 CAD | 3,500 | $276K | $3.48B CAD | $110MM |

| Amerigo Resources | $1.16 | 309,000 | $358K | $198MM | $261K |

| Amarillo Gold | $0.265 | 715,000 | $189K | $110MM | $34K |

| Neo Performance Materials | $19.06 | 11,000 | $210K | $714MM | $1.64MM |

| Sherritt International Corp. | $0.52 | 250,000 | $130K | $211MM | $692K |

| Solaris Resources Inc. | $9.28 | 16,230 | $151K | $975MM | $1.5MM |

| High Gold Mining Inc. | $1.36 | 42,500 | $58K | $76MM | $124K |

| Orca Gold Inc. | $0.64 | 100,000 | $64K | $164MM | $81K |

| Total: | $6.78MM |

Figure 3. Current value of investments is $6.78MM. I am excluding the other investments of $1MM, because they are negligible, and they fail to identify what they are. The debentures and private stock are illiquid. Remember, this is a conservative approach.

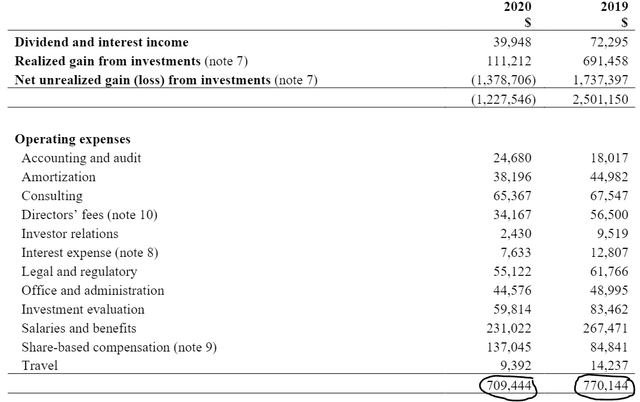

Their cash burn rate is $700K per annum, so that leaves us a large margin of safety even if takes some years to realize our value (stock appreciation will be much quicker than that due to share buyback.)

Figure 4. Cash burn rate is 700K per annum.

For these net net stocks, most important is their cash burn rate. Because if the stock doesn't rerate before the market realizes its value, it won't be a net net anymore, because they burned too much cash.

Insider buying:

An insider only buys to make money. He knows his stock more than any of us (outsiders.) These are open market purchases.

| Name/Position | # Shares Quantity | Share price | $ value | Date |

| Cai Ken- CEO | 300,000 | 0.045 | $13500 | 2020-03-18 |

| Malcolm Clay- Director | 20,000 | 0.09 | $1800 | 2020-05-20 |

| Malcolm again. | 50,000 | 0.075 | $3750 | 2021-01-31 |

Figure 4. Open market orders insider buying.

These are minuscules insider purchases, but cannot buy more without moving the price.

Risks:

**Majority of the exposure is in Minco Silver Corp, a falling stock price will have a material negative impact on Minco Capital Corp share price.

***Global x Lithium & Battery Tech ETF is denominated in USD. A negative impact to the USD currency rate should not have a material impact to the Minco Capital business because the USD exposure is so less.

Please note I am excluding the poor bid ask spreads on these illiquid stocks so this is not a fair representation of what actual money you can get if you sell the stock. Because there are so many shares to sell, this will severely depress share price and take a long time to get out of the position (Minco Silver Corp). To give an idea of its liquidity, I have included the market cap of the company and the 3-month average daily dollar traded volume.

I don't know if these stocks are going to move down; if so, they will have a material negative impact on the Minco Capital Corp. share price. All these stocks have been going down, so maybe there is reversion to mean? There is no fundamental analysis.

If management doesn't buy back enough shares, it won't go to $0.17/share, because I am sure the market doesn't value this company so there will be no outside bidders.

I expect the company to bid the stock up to $0.17/share, giving a large margin of safety. Please note I accumulated my position at $0.08/share so I am already in profit zone. I am not comfortable accumulating shares at the current price point ($0.105/share.)

Management has been granted 3,600,000 stock options to its officers, directors, employees and consultants at an exercise price of $0.12 per common share for a term of five years. These options vest over 18 months from the grant date April 28, 2020. Management may short the stock to liquidate their option portfolio, however since their intention is to not sell stock (as of yet) until the share buyback is done in March 2022, this shouldn't be a problem?

Also, Melinda Hsu replaced Larry Tsang as CFO effective April 1, 2020, not that it makes a difference.

Future speculative hope:

In August 2020 the company announced they engaged Durose Asset Management Inc. (“DAMI”) as its financial advisor to manage its gold and other precious metals investment portfolio. He has extensive industry experience in mining and metals. On his website he says his four guiding investment principles are: 1) we like dividend-paying companies; 2) we seek deep value and growth; 3) we don't hug an index; 4) we value high-quality insightful research. However we need to call him to ask for past performance of equities because it not listed publicly.

I don't think this changes much because he was on the board of directors (has since stepped down to prevent conflict of interest) for 3 years, and still the company lost so much money on its investments. So I don't think that changes much. However, there is always mean reversion, who knows.

Why this opportunity exists:

Minco capital has been ruining shareholder equity ever since inception with it's poor investment choices to the point where the market doesn't even value the net cash and public stock it has (relative to market cap.) However the share buyback will boost stock price closer to book. Management acknowledges the shares are trading at a steep discount to liquid book (according to MD&A.), and are writing it off as retained earnings when they buy back stock.

How I found this opportunity:

I read through SEDAR filings everyday (quarterly earnings report) searching for bargains. Looking for net-nets (with a catalyst- share buyback/specials dividend.), turnarounds, low EV/EBIT (normalized EBIT, of course.); any deep bargains overlooked by the market.

That's why I focus on Canadian microcaps, low institutional ownership, no analyst coverage, illiquid; hedge funds cannot get in.

I am posting about four more bargains I am long. These are undiscovered microcaps in the Canadian space. Subscribe so you don't miss my posts.

Disclosure: I am/we are long MMM.V.

No comments:

Post a Comment